Discovering the best paying accounts in 2026 is crucial for anyone aiming to maximize their savings and grow their wealth effectively. This guide explores various financial products designed to offer superior returns compared to traditional options. We delve into high-yield savings accounts, Certificates of Deposit, and money market accounts, understanding where your money can work hardest for you. Learn about the features, benefits, and considerations for each type of account, ensuring you make informed decisions tailored to your financial goals. Whether you are saving for a down payment, retirement, or simply building an emergency fund, identifying the right high-interest opportunities is key. Stay ahead with the latest insights on competitive interest rates and optimal account management strategies. Making smart choices for your best paying accounts can truly transform your financial outlook, helping you achieve peace of mind and substantial growth.

Navigating Your Financial Future: Discovering the Best Paying Accounts for 2026

In 2026, finding the best paying accounts means understanding where and how your money can grow most effectively, whether through high-yield savings, Certificates of Deposit, or money market options. These accounts offer superior returns for individuals seeking to maximize their wealth, providing opportunities to secure financial stability and achieve personal goals. Smart selection involves comparing current interest rates, account features, and terms to ensure your funds are working their hardest for you right now, wherever you choose to bank. Let's explore how to identify and leverage these top-performing accounts to unlock your earning potential.

What Makes an Account a Best Paying Account?

A best paying account is essentially any financial product that offers significantly higher returns on your deposited money compared to standard offerings. These can include various savings vehicles, designed to help your funds grow faster over time. The primary goal is to provide you with more interest, making your money work harder for your financial future. It's about optimizing where you keep your cash to ensure maximum benefit from your chosen best paying accounts.

High-Yield Savings Accounts: Your Pathway to More Earnings with Best Paying Accounts

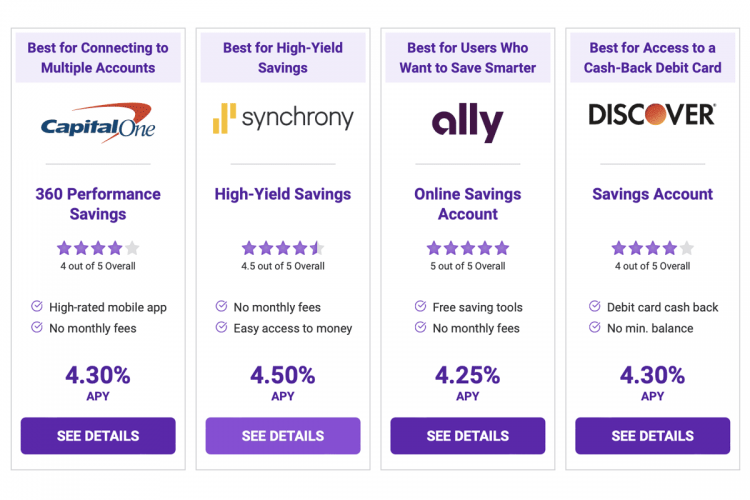

High-yield savings accounts (HYSAs) are a fantastic option for anyone looking to earn substantially more on their savings than traditional bank accounts provide. These accounts typically offer annual percentage yields (APYs) that are many times higher than conventional options. Many HYSAs are offered by online banks, which often have lower overheads and can pass those savings on to you as better rates. Always check the current APY, minimum balance requirements, and any potential fees to find the ideal high-yield savings accounts.

| Account Type | Typical APY Range | Accessibility | Best For |

| High-Yield Savings Accounts | 4.00% - 5.50% | Easy access, some transfer limits | Emergency funds, short-term savings goals |

| Certificates of Deposit (CDs) | 4.50% - 6.00% (longer terms) | Funds locked for term, early withdrawal penalties | Guaranteed returns, specific future needs |

| Money Market Accounts | 3.50% - 5.00% | Limited check writing, ATM access | Savings with some transactional flexibility |

Certificates of Deposit (CDs): Locking in Your Returns with Best Paying Accounts

Certificates of Deposit, often called CDs, are time-deposit accounts where you agree to keep your money deposited for a specific period, or 'term'. In exchange for this commitment, the bank pays you a fixed, often higher, interest rate than traditional savings. CDs are excellent for funds you will not need immediate access to, providing a predictable growth path for your savings. Always consider the term length and early withdrawal penalties when exploring the best paying accounts like CDs.

Money Market Accounts: A Blend of Savings and Flexibility with Best Paying Accounts

Money market accounts (MMAs) offer a unique hybrid of savings and checking account features, making them a versatile choice among the best paying accounts. You typically earn a competitive interest rate while also having limited check-writing privileges and ATM access. These accounts are ideal if you want your money to grow but still need occasional access to it without the strict limitations of a CD. Be sure to review transaction limits and any monthly service fees when choosing these best paying accounts.

What Others Are Asking? Finding Your Best Paying Accounts

What is the highest paying savings account today?

The highest paying savings accounts vary frequently, often found with online banks that offer annual percentage yields (APYs) exceeding 4.50% or even 5.00%. It is crucial to compare current rates from reputable institutions, as these can change weekly based on market conditions and Federal Reserve policies. Regularly checking financial news sites and comparison tools will help you identify the absolute top performers for your savings in 2026.

Which banks offer the best paying accounts for savings?

Many online-only banks and credit unions frequently offer the best paying accounts for savings due to their lower operating costs. Look for institutions like Ally Bank, Marcus by Goldman Sachs, Discover Bank, and Capital One 360, which consistently provide competitive high-yield savings rates. Smaller, local credit unions can also sometimes surprise with excellent rates, so it pays to research various options before committing your funds.

Are high-yield savings accounts safe?

Yes, high-yield savings accounts are generally very safe, especially when held at institutions insured by the Federal Deposit Insurance Corporation (FDIC) for banks or the National Credit Union Administration (NCUA) for credit unions. This insurance protects your deposits up to 250,000 per depositor, per institution, ensuring your money is secure even if the financial institution fails. Always confirm FDIC or NCUA insurance status for peace of mind.

What is a good interest rate for a savings account in 2026?

In 2026, a good interest rate for a savings account would typically be anything above the national average, ideally starting around 4.00% APY and higher. With evolving economic conditions, competitive rates from the best paying accounts can even reach 5.00% or more. Always compare current market offerings and consider whether the rate is fixed or variable, ensuring it meets your financial growth expectations.

How can I find the best paying accounts with no fees?

To find the best paying accounts with no fees, focus your search on online banks and credit unions, which are more likely to offer fee-free savings and checking options. Carefully read the account terms and conditions to identify any hidden fees, minimum balance requirements to waive fees, or excessive transaction charges. Many high-yield accounts specifically market themselves as having zero monthly maintenance fees, making them excellent choices.

FAQ: All About the Best Paying Accounts

What are best paying accounts?

Best paying accounts are financial products like high-yield savings, CDs, and money market accounts that offer significantly higher interest rates than standard options. They aim to maximize your return on deposited funds, helping your money grow faster.

Who should use best paying accounts?

Anyone looking to grow their savings more aggressively than traditional bank accounts allow should consider best paying accounts. They are ideal for emergency funds, short-term savings goals, or long-term wealth building, empowering your financial journey.

Why are best paying accounts important?

These accounts are important because they combat inflation and accelerate wealth accumulation. By earning more interest, your purchasing power is better preserved, and your financial goals become more achievable over time, securing your future.

How do I open best paying accounts?

Opening best paying accounts typically involves an online application with a bank or credit union. You will need to provide personal identification, deposit an initial amount, and agree to the account's terms and conditions, a straightforward process for better returns.

Key Takeaways on Best Paying Accounts

Choosing the best paying accounts involves understanding your financial goals and risk tolerance. High-yield savings offer liquidity, while CDs provide guaranteed returns for fixed terms. Money market accounts balance accessibility with competitive interest. Always prioritize FDIC or NCUA insured institutions to protect your deposits. Regularly reviewing rates ensures your money is always working its hardest for you. Empower yourself by making informed decisions today, securing your financial future with the best paying accounts.

High-yield savings accounts offer competitive interest. Certificates of Deposit provide fixed, higher returns for specific terms. Money market accounts combine savings and limited checking features. Understanding account types maximizes your earning potential. Compare rates, fees, and accessibility before choosing your best paying accounts. Always seek FDIC or NCUA insured institutions.

10 Best Checking Accounts Of October 2024 Standard Best Checking Accounts Social Share 11 Best Savings Accounts For January 2026 Up To 4 35 NerdWallet Banking Bank Credit Union Figma Vs Adobe Which Design Tool Is Better In 2026 The Rich Guy Math Slot 0 1024x683

Roles And Of Regional Sales Managers PPTX 54562052 Thumbnail Best Of Money Awards 2025 MoneyGenius Best Chequing Account 2025 Award Seal 2026 Payroll Calendar GSA Month 2026 01 Jan 570x620 2026 Savings Challenge Tracker Printable Money Saving Chart Digital Il 37zl

Ontario Living Wage The Cost Of Living In Ontario S Key Regions Best Premium Accounts Conventions Of The Fantasy Genre PPTX Fantasy Genres 01729383 Thumbnail The 6 Best High Interest Checking Accounts For September 2023 Best Savings Account Sept Featured 750x500 Highest Paying Jobs In South Africa 2026 Salary Guide Job Dogs File

Best Dividend Paying ETFs In Australia 2025 Review Guide SIGA Best Suburbs To Invest In Australia 2026 - Where To Invest Next Mobile IRS Announces 2026 Retirement Plan Limitations CAPTRUST 2026 IRS Limits Numbers Updated V1 1024x549 10 Best Money Market Accounts Of September 2025 Best MMA January 2025 Best Bank Accounts In Canada January 2026 Frugal Flyer Frugal Flyer Bank Account Comparison Tool For Chequing And Savings Accounts 768x561

Best Savings Accounts 2026 Save The Student Student Bank Accounts Head 1 385x200 The 13 Highest Paying Accounts Payable Specialist Jobs In 2026 Top 13 Highest Paying Accounts Payable Specialist Jobs In 2025 With Salary Ranges.webpPrepare For 2025 RxDC Reporting Marshall Sterling 2025 2026 HRA And HSA Limits Best Savings Accounts 2026 Save The Student Open Wallet With Sterling Money Notes3 385x200

Best Bank Account Bonuses For January 2026 Up To 1 000 Top 5 Best Saving Account Opening 2025 High Interest Savings Account 2026 Jeep Grand Cherokee Reliability Consumer Ratings Pricing IrisNew 2026 Tax Brackets What The IRS Just Announced New Tax Brackets

The Best Kids Savings Accounts In Australia For 2026 Money Magazine Money Bob 2026 2026 Pay Raise White House Budget Likely To Recommend Federal Pay Freeze 2026 Federal Pay Raise GS Pay Scale Table Pay Freeze 1024x576 Top 10 For 2026 Highest Paying Skilr Blog Top 10 2026 Highest Paying Jpg.webpTrading Profit And Loss Account Format Rupeezy Image

Top 10 Best Billing Software For Accounting Invoicing In 2026 Top 10 Best Billing Software For Invoicing Account Management 2026 2026 Metabolites Impact Factor Ranking Research Scope Research Com Best Accelerated Accounting Degree Programs Online 118d11c4e4 Best Bank Accounts In Canada January 2026 Frugal Flyer Best Bank Accounts In Canada Piggy Bank Featured Image 768x512 List Of Highest Stipend Paying 2026 Intake DAAD Fully List Of Highest Stipend Paying 2026 Intake

Best High Interest Checking Accounts For January 2026 Up To 6 75 BestHigh 2026 Limits Announced For Health Savings Accounts The Insurance People 2025 Inflation Adjustments Blog Square Highest Paying Jobs In 2026 Top Careers Highest Paying Jobs In 2026 1024x671

:max_bytes(150000):strip_icc()/BestHigh-YieldSavingAccounts-cf61d112a9254710acfed7122a31a417.jpg)

:max_bytes(150000):strip_icc()/BestMoneyMarketAccountRates-2ef5579747b046948bb148957f4185a7.jpg)